Law Change on Contractor vs Employee

Employment Law / 30 September 2024

A recent Court of Appeal decision in the Uber case found that Uber drivers described as independent contractors, were in fact deemed employees, this decision has potential implications for many industries where use of contractors is common.

Following a coalition agreement obligation, the government has announced potential changes to employment law to clarify whether a worker is an employee or contractor. This would override the Uber test and long line of cases around deemed employees.

The coalition agreement between National and ACT states that they will “maintain the status quo that contractors who have explicitly signed up for a contracting arrangement can’t challenge their employee status in the Employment Court”.

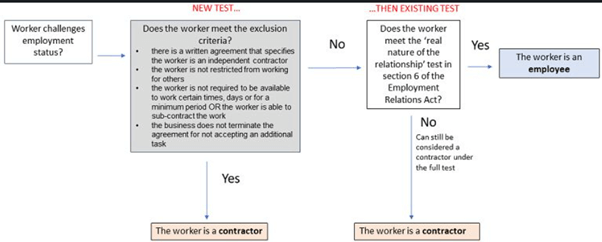

The proposed amendment to the Employment Relations Act would add in a test with four criteria to uphold contractor status:

- A written agreement with the worker, specifying they are an independent contractor.

- The business does not restrict the worker from working for another business (including competitors)

- The business does not require the worker to be available to work on specific times of day or days, or for a minimum number of hours OR the worker can sub-contract the work.

- The business does not terminate the contract if the worker does not accept an additional task or engagement.

If all four criteria are met, then the worker would maintain their status as a contractor and would not be a deemed employee. If one of the four criteria did not apply, then the existing legislation s6 employee verses contractor test would apply.

Workplace Relations and Safety Minister Brooke van Velden said the changes would provide greater certainty for contractors and businesses. The changes are aimed to be introduced in 2025,

“The current process for workers challenging their employment status through the courts can be costly for business and can increase business uncertainty in general” van Velden said.

Clarifying the contractor status gives employers certainty without having to test it through the employment courts.

Message for Employers

If you have not had your independent contractor arrangements reviewed recently, the risk of challenge in the current landscape is significant. We recommend seeking advice on these arrangements to ensure the relationship is accurately reflected.

Disclaimer: We remind you that while this article provides commentary on employment law, health and safety and immigration topics, it should not be used as a substitute for legal or professional advice for specific situations. Please seek legal advice from your lawyer for any questions specific to your workplace.